UV Metrics provides individual investors with information that will help them discover tomorrow’s top performing stocks . . . today! We do that by eschewing traditional investment screens such as P/E Ratios and Dividend Yield, neither of which will help in the discovery of stocks such as Nvidia, Tesla, Netflix, and Amazon.com. In the process of becoming top-performing stocks, none of these companies generated earnings or paid dividends. What each of these companies had in common was extraordinary year-over-year Quarterly Revenue Growth, and that is the metric at the core of our research.

Why is our service relevant? Because the US economy is in the early stages of The Digital Transformation.

“AI will be the best investment opportunity of our lifetime because of the impact it will have on GDP. The potential of AI to revolutionize nearly every sector, boost productivity, reduce costs, and significantly influence GDP is unparalleled. To be exact, AI is estimated to add up to $15.7 trillion to the global economy by 2030 and drive a market five times the size of tech’s current global spend.“

AI is the Best Investment Opportunity of Our Lifetime – Beth Kindig, October 5, 202

“As technology continues to evolve, the financial markets will continue to transform. Investors who embrace these advancements and use them to their advantage will be able to reap the benefits of the new investment landscape. In the future, the financial markets will be unrecognizable from the ones we know today, and technology will be the driving force behind the changes. The potential of these advancements in the financial markets is immense, and it is likely to continue to disrupt and transform the investment landscape in the years to come.”

How Technology Is Transforming the Investment Landscape, Forbes, Feb 14, 2023

Try our service FREE for two months. No credit or debit card information is necessary. All I need is your email address. You will be added to my Distribution List for two months. If at the end of that two-month period you have found no value in our service, I will simply remove your email from my Distribution List.

If you determine that my service has proven to be of value to you, just select the Subscribe icon above and complete the required information. Upon becoming a Member, I will send you a free copy of my book – Investing in the Age of Digitalization,

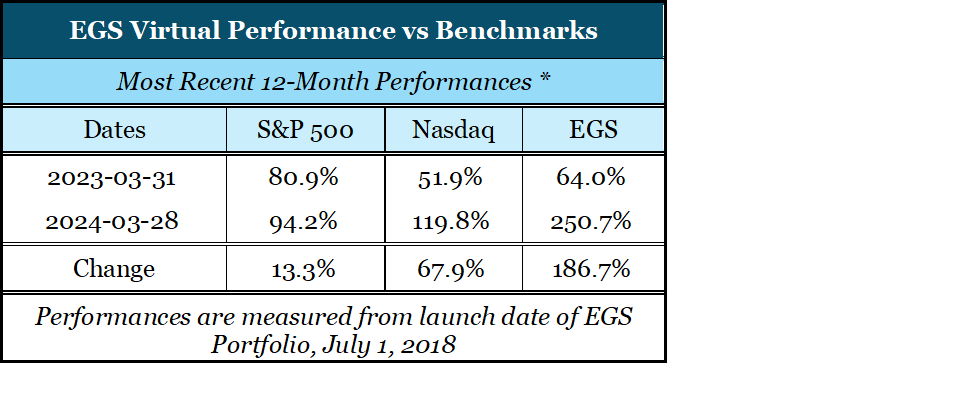

Here’s how the EGS virtual portfolio has performed during the most recent 12-months and since launched July 1, 2018:

So, why should you consider subscribing to my service?

There are four reasons why you might want to consider subscribing to my service by becoming a Member:

First, a learning experience: Over the past five-years I’ve searched the Internet for credible sources of information relating to the Digital Transformation. Many of those sources offer email updates which I’ve subscribed to. I receive hundreds of those updates daily, and those which are significant and relevant – and many are neither – are summarized and shared with Members via emails.

Second, a time-saver for you. As mentioned above, you will not have to search the Internet for credible sources of information, nor will you have to sift through hundreds of daily emails to determine which are significant and relevant.

Third, a money-saver for you. I spend hundreds of dollars every month for subscriptions to proven, profitable sources of investment research.

Fourth – as demonstrated in the above performance charts – a potential wealth-builder for you.

When any investment ideas qualify for my Quarterly Revenue Growth metrics and become Picks, my explanation for those Picks is shared immediately via emails with Members.

As you look at the Year-to-Date Performance Chart above, keep in mind that most professional investment management firms – including hedge funds and mutual funds – strive to match or beat the performance of the S&P 500 . . . and, according to a September 9, 2023 article in The Wall Street Journal, 90% fail to do so.

The Performance Chart (above) is updated at the end of each month.