My name is Paul Christiansen and this is my website.

My goal in managing this website is to help individual investors to increase their wealth.

What are my qualifications for achieving such a praiseworthy goal?

Let’s start at the beginning of my odyssey to try to answer that rhetorical question.

I spent most of my early career as a stockbroker for several Wall Street branch offices in Rochester, NY. I was convinced that being rewarded for helping folks to increase their wealth was an ideal “Win/Win” endeavor. All that was needed was a steady stream of wealth-building investment ideas from the research departments of the companies for whom I worked.

I never discovered that “steady stream” and that launched me on a search to determine if, indeed, such a steady stream might exist.

The following quote from Robert Bloch’s wonderful book, The Warren Buffet Book of Investing Wisdom, suggests that The Oracle of Omaha understood my frustration in not being able to discover that steady stream:

“Wall Street is the only place that people drive to in a Rolls-Royce to get advice from those who take the subway.”

As you review the following information, I think you might agree that my search for that repeatable steady stream has been very successful.

During years of searching, I managed to self-publish three books, the most recent being Investing in the Age of Digitalization which is available on Amazon.com.

I explored several possible strategies before I finally discovered the strategy that has generated the performances detailed below.

That strategy is embodied in a wonderful, insightful quote from the legendary investor, Warren Buffet.

“Writing a check separates commitment from conversation.”

That led me to my mantra . . .

Companies that generate consistent, above percentage increases in quarterly year-over-year revenues will almost always produce higher stock market values.

That sort of quarterly performance can only be generated by lots of customers writing lots of checks – it reflects commitment. Those companies deliver products or services for which a growing number of customers are writing checks.

I am reluctant to add stocks to my EGS Model Portfolio based upon “conversation” or hype from Wall Street sources. However, if the “hype” is genuinely compelling and if I can reasonably anticipate future percentage increases in year-over-year revenues I sometimes make exceptions.

So, let’s cut to the chase.

My performance.

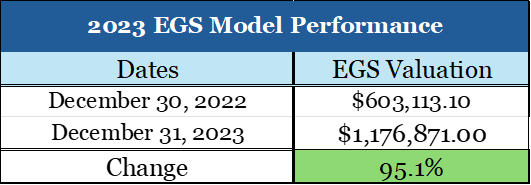

To demonstrate the efficacy of my skills in discovering stocks with extraordinary growth potential I launched the EGS Model Portfolio (Extraordinary Growth Stocks) in July 2018.

Have I been successful in our discovery efforts?

In the 2023 Wall Street Journal’s Winner Circle ranking of 1,191 hedge funds, the top two funds returned 65.2% and 59.1%.

If the EGS Model Portfolio were a hedge fund, my 95.1% growth would have ranked #1 in the 2023 Wall Street Journal’s Winner Circle rankings.

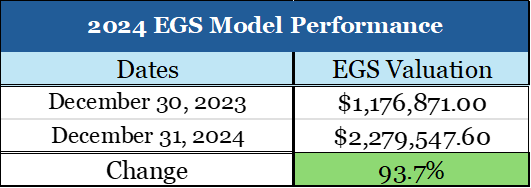

In 2024, based upon results provided by Gemini and confirmed by HSBC, Bloomberg and Reuters, the top two hedge funds generated returns of 61.8% and 59.4% for their investors. Clearly, if the EGS Model Portfolio were a hedge fund, my 93.7% growth would have ranked #1 among ALL hedge funds.

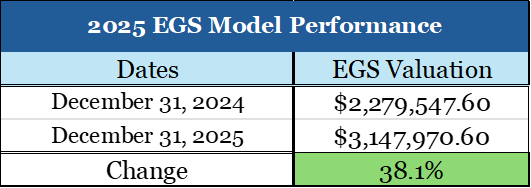

In 2025, I stumbled a bit. However, based upon the results provided by Gemini, the top two hedge funds generated returns of 45.1% and 37.0% for their investors. Clearly, if the EGS Model Portfolio were a hedge fund, my 38.1% growth would have ranked #2 among ALL hedge funds.

Few individual investors have more than $3 million to replicate the performance of the EGS Model Portfolio going forward.

However, a portfolio is a collection of individual stocks (almost always limited to 25-stocks in the EGS Model Portfolil) and it is the collective performance of those individual stocks that generate the performance of a portfolio.

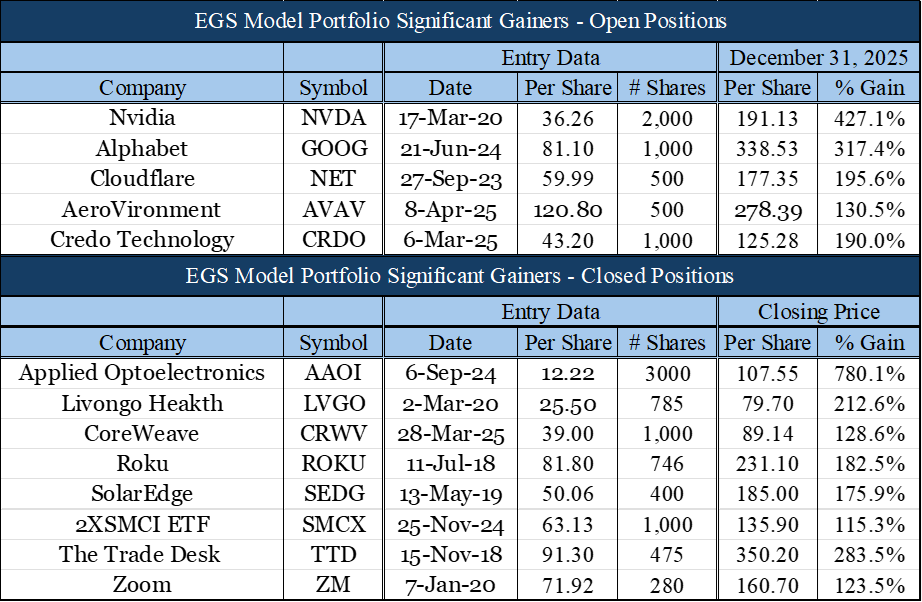

The following stocks did much of the “heavy lifting” for the EGS Model Portfolio. To be sure, there were negative individual stock performances, and they are included in the overall performance of the portfolio.

While most individual investors are familiar with NVDA, GOOG, ZM and ROKU, I would suggest that very few would be familiar with AAOI, NET, AVAV, CRDO, LVGO, CRWV, SEDG, SMCX and TTD. Interestingly, every one of those stocks at least doubled in stock market value!

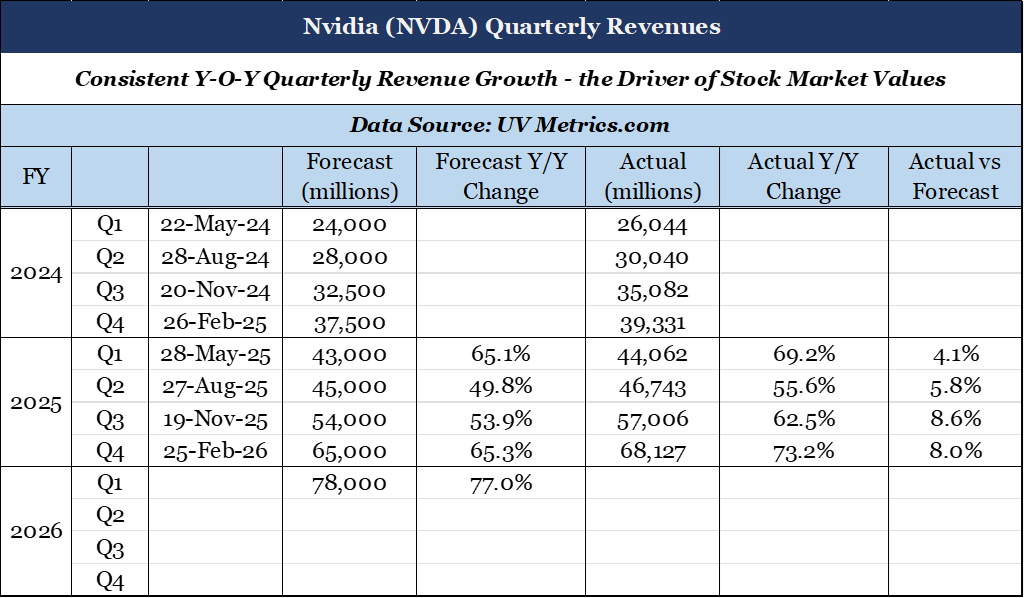

The following chart illustrates my long term perspective, and why Nvidia has remained in the EGS Model Portfolio:

Whenever a stock is added to the EGS Model Portfolio, all the research supporting that addition is emailed to Members immediately. Therefore, Members will almost always be able to Buy that stock at a price close to the price at which it has been added to the portfolio.

Unlike most services that offer investment ideas for subscribers, I continuously scan the web for pertinent information relevant to the 25-stocks in the EGS Model Portfolio. Often that information involves Wall Street analysts’ Target Prices.

To illustrate that follow-up service, after I entered Nvidia as a selection for the EGS Model Portfolio, I discovered 29-relevant information sources that were shared with Members on the day of discovery. Most of these discoveries enabled Members to “stay-the-course” and maintain their Nvidia positions, thereby precluding the temptation to prematurely nail down profits.

In addition, every month I publish two reports that offer significant value to Members

EGS Monthly Performance – This report shows the performance – from date of entry to end-of-month – for every stock in the Portfolio. Members can compare the performance of stocks they own with all stocks in the Portfolio.

EGS Quarterly Revenue – This report lists the four most recent quarterly revenue growth percentages for each of the stocks in the Portfolio, including the most recent. This Report also compares management’s Projected Revenue Growth with the Actual Revenue Growth for their most recent Quarterly Report, thereby revealing management’s ability to Forecast. Most importantly, this Report also reveals management’s Forecast for their next quarterly report.

All of my reports are very valuable in helping Members to make both Buy and Sell decisions. For example, when an analyst lowers his/her rating or price target for a specific stock, that suggests that it might be time to sell. Also, if there is a significant decrease in quarterly revenue growth, that might also represent a signal to sell. Finally, if a specific stock is a laggard relative to all other stocks in the EGS Model Portfolio, it might be prudent for Members to consider an investment in one of the stocks that offer better profit opportunities.

You are invited to participate in a FREE one-month trial subscription. All I need is your email so you can be added to my Distribution List, featuring relevant research reports and any additions/deletions made to the EGS Model Portfolio. At the end of the one-month trial subscription, you will have the option of either becoming a subscribing Member – or not. If the latter, I will simply remove your name from my Distribution List – period. No need for credit/debit card entries – ever, unless, of course, you become a subscribing Member.

To participate in the FREE one-month trial subscription, just send me your email address at the following address:

paulchristi@gmail.com

The monthly Membership fee is just $30.

Note: We do not share your personal information with any other entity.

UV Metrics does not make recommendations or solicitations for the sale or purchase of any security – ever.

We are not licensed to do so and wouldn’t do it even if we were.

We share research to enable you to become more knowledgeable when making your own decisions.